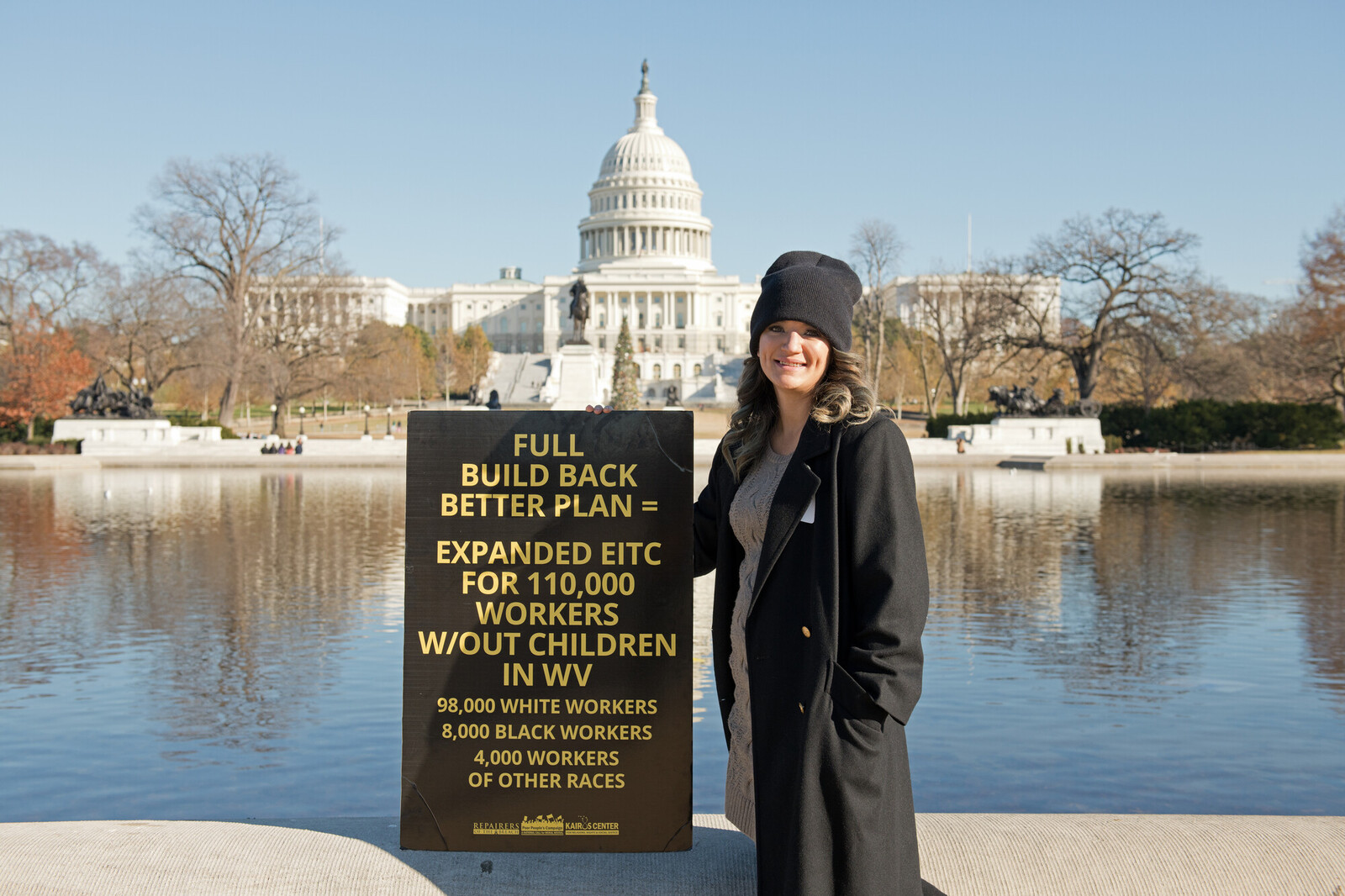

At a Poor People's Campaign action in Washington, D.C., JoAnna Vance highlighted the stories of thousands of West Virginians helped by the Child Tax Credit. Bryan Vana / AFSC

For nearly a year, advocates and community organizers have urged Congress to pass the Build Back Better Act. The bill is one-in-a-lifetime opportunity to transform our social safety net and improve the lives of millions of people across the United States.

The bill would invest directly in U.S. families and workers, expand health care access, and respond to climate change. It would help millions meet basic needs amid the still-raging pandemic and deepening structural inequality.

But right now, the Build Back Better Act faces tremendous hurdles in Congress. And it’s important that we keep pressuring lawmakers to ensure they don’t waste this critical opportunity.

Here’s what you need to know about the bill.

It’s urgent that Congress pass the Build Back Better to help people’s basic needs in this pandemic.

Many emergency pandemic relief programs are ending just as COVID-19 cases are ballooning nationwide. That means millions of people across the U.S. have started 2022 without needed support through illness or economic hardship.

That includes millions of families who rely on the increased Child Tax Credit payments expanded in response to the pandemic. In its first six months, the expanded tax credit has slashed child poverty and enabled families to pay for necessities like food, housing, and utilities. At least 4.7 million children have benefited. But unless the Senate passes the Build Back Better bill immediately, this vital assistance will be ripped away this month.

The Senate filibuster has complicated the situation. With a 60-vote supermajority generally required to pass legislation, congressional leadership is attempting to pass Build Back Better through the budget reconciliation process. This process requires a 50-vote simple majority to pass the bill. During the negotiation process, several lawmakers have called for harmful changes to the bill. Fortunately, determined efforts by advocates and organizers have kept critical investments in the legislation.

On Nov. 19, the House of Representatives passed their version of bill, sending it to the Senate. However, Senate leaders still face resistance from moderates including Sen. Joe Manchin of West Virginia. Now we must keep calling on all senators to pass Build Back Better as soon as possible.

Build Back Better would improve the lives of millions of people across the U.S.

The importance of the expanded Child Tax Credit for families around the country cannot be overstated.

Last month, AFSC staff members JoAnna Vance and Guadalupe De la Cruz joined many in testifying to the importance of the legislation at a Poor People’s Campaign Moral March on Washington.

JoAnna shared that the Child Tax Credit has been a huge relief to her family. It has helped them pay medical bills, maintain the family vehicle, and cover expenses when they were sick due to COVID-19 and unable to work. In an open letter to Sen. Manchin on CNN, JoAnna highlighted the stories of hundreds of West Virginians who have also benefited from the program.

Guadalupe said that as a single mother, even working three jobs sometimes left her living paycheck to paycheck. She was not always able to pay for rent, utilities, and groceries. “For the first time, I could pay multiple bills and leave the worry behind,” she said. “[The continuation of this program] ensures a future where every child has what they need to grow and thrive.”

Beyond the Child Tax Credit, the Build Back Better Act would also:

- Expand access to free school meals and extend their availability to the summer.

- Expand free pre-K programs and increase access to affordable childcare services.

- Allow workers to take paid time off from work to care for themselves and others.

- Fund new Housing Choice Vouchers for about 300,000 households.

- Extend the expansion of the Earned Income Tax Credit.

- Make higher education more affordable and accessible.

- Close the Medicaid coverage gap.

- Lower insurance premiums and prescription drug costs.

The current bill also includes provisions to allow undocumented immigrants who have been in the United States since 2010 to temporarily live and work without fear of deportation. An advisory opinion from the Senate parliamentarian has undermined efforts to include a more permanent solution for undocumented people. But if the Senate rightfully bypasses this opinion, the bill could finally provide a pathway to citizenship for millions in the United States.

Crucially, the bill makes monumental investments in responding to climate change. It includes tax incentives for clean energy producers and consumers, tax benefits for electric vehicle buyers, and direct investments in sustainability projects.

Ultimately, the Build Back Better Act is an essential step toward a more equitable society. The bill could reduce racial and ethnic disparities in poverty, health, housing, education, and environmental justice. If the bill passes, people of color will make up 70% of those who would receive new housing vouchers and 60% of people who will get health care coverage.

We need investments in our communities—not in war and militarism.

Per year, the cost of the Build Back Better Act would amount to just one-quarter of this fiscal year’s $778 billion defense budget, which Congress passed easily in December. What’s more, the Build Back Better Act pays for itself by reducing tax breaks for corporations and the very wealthy.

Our federal budget should reflect our nation’s priorities. It’s long past time for the U.S. to divest from harmful militarized spending—and instead invest in programs that will improve the lives, health, and well-being of our communities.

The Senate has the opportunity NOW to make transformational investments for communities across the U.S. Let’s put people first and pass the Build Back Better Act without leaving anyone behind. Our communities deserve nothing less.